Vault Liquidity Frameworks

VLF Vaults

Detailed guide to VLF Vaults and how the supply and reclaim processes work

VLF Vaults represent claims on the underlying assets (principal) and the generated yields (interest) from the liquidity opportunities using different VLF structures.

Users can participate in liquidity opportunities by supplying hub assets to VLF Vaults:

Users can participate in liquidity opportunities by supplying hub assets to VLF Vaults:

Unlike supply, the reclaim (redemption) process is not immediate and involves three main stages managed by the ReclaimQueue contract:

Unlike supply, the reclaim (redemption) process is not immediate and involves three main stages managed by the ReclaimQueue contract:

Key Characteristics

- Campaign-Specific: Each VLF Vault represents a specific liquidity opportunity for a specific hub asset

- ERC-20 Standard: VLF Vaults adhere to the ERC-20 standard for seamless integration

- ERC-4626 Interface: Implements ERC-4626 interface for standardized vault interactions

- Yield Generation: Designed to generate yield through strategic DeFi protocol integrations

- Deposit Caps: Implements configurable deposit limits to manage risk, ensure controlled growth, and maintain strategy efficiency

VLF Asset Properties

VLF Assets such as mi/maAssets (tokens representing shares in VLF Vaults) have the following properties:- Yield-Bearing: Automatically accrue yield from underlying strategies

- Reclaimable: Can be reclaimed for underlying hub assets through the reclaim process

- Composable: Can be used in other DeFi protocols

- Capped Supply: Subject to deposit limits that prevent excessive vault growth

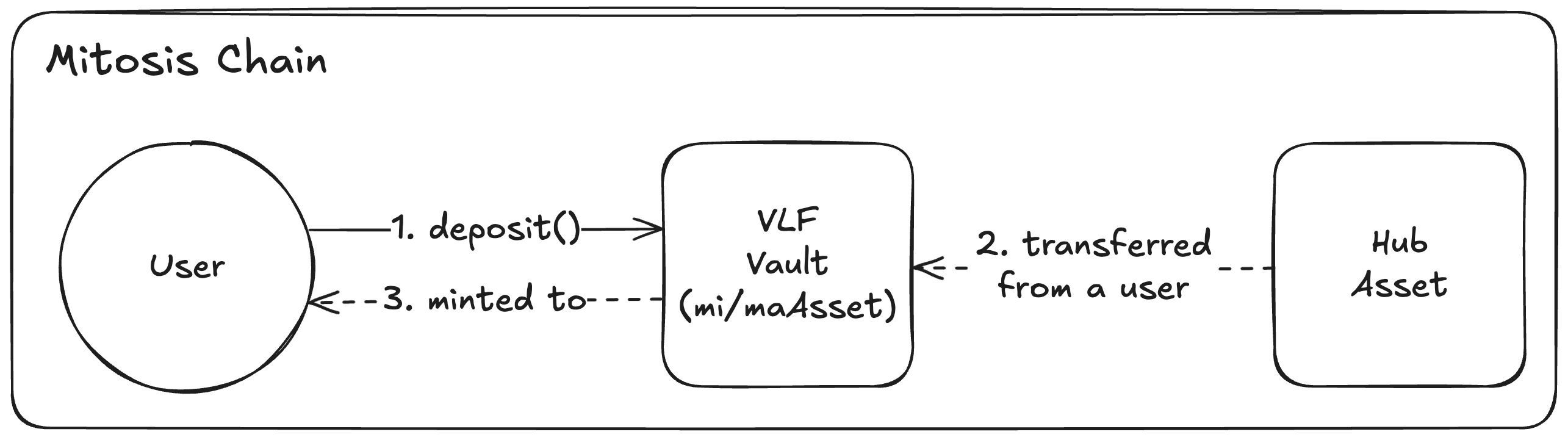

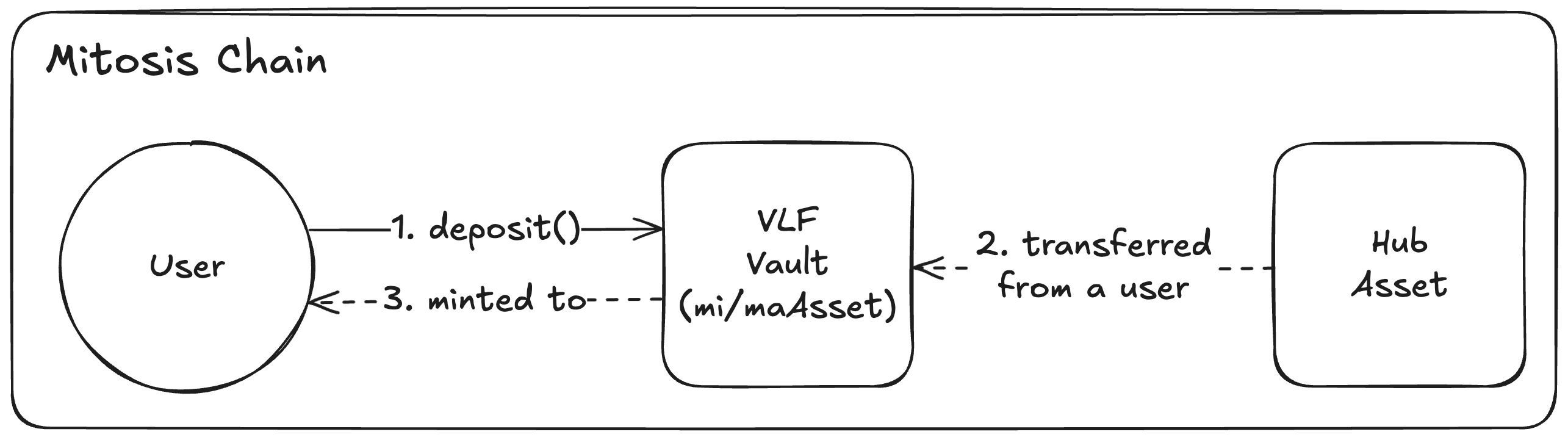

Supply Process

Users can participate in liquidity opportunities by supplying hub assets to VLF Vaults:

Users can participate in liquidity opportunities by supplying hub assets to VLF Vaults:

1

Check Deposit Limits

Verify current deposit limits using

vault.maxDeposit(userAddress) and vault.maxMint(userAddress) before attempting to supply assets2

Supply Hub Assets

Hub assets are transferred from user to VLF Vault

3

VLF Asset Minting

Corresponding amount of VLF assets are minted to the user

4

Strategy Allocation

Supplied hub assets become available for strategist to deploy in yield-generating strategies

Cap Changes: Deposit caps may change based on strategy performance and market conditions.

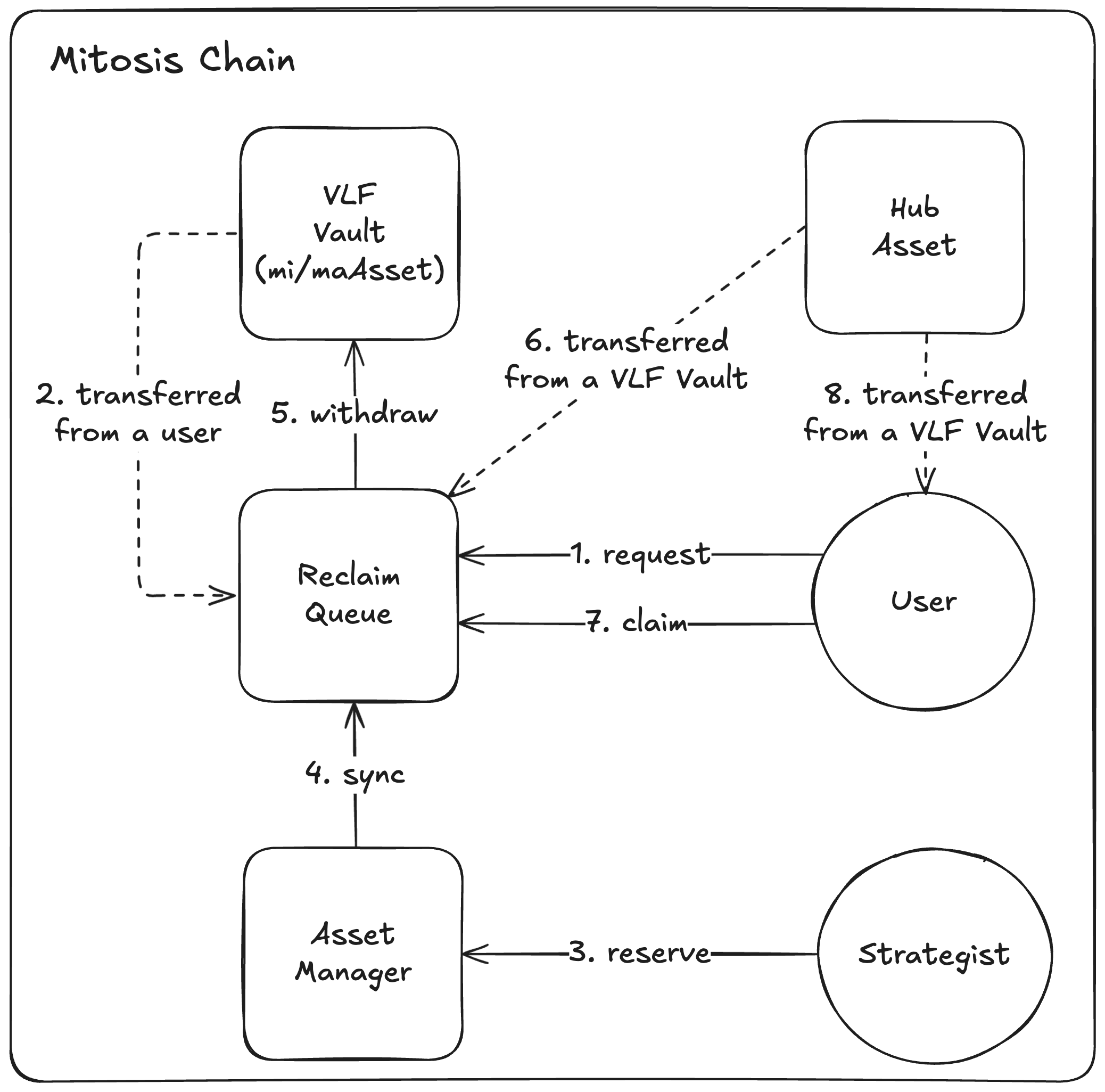

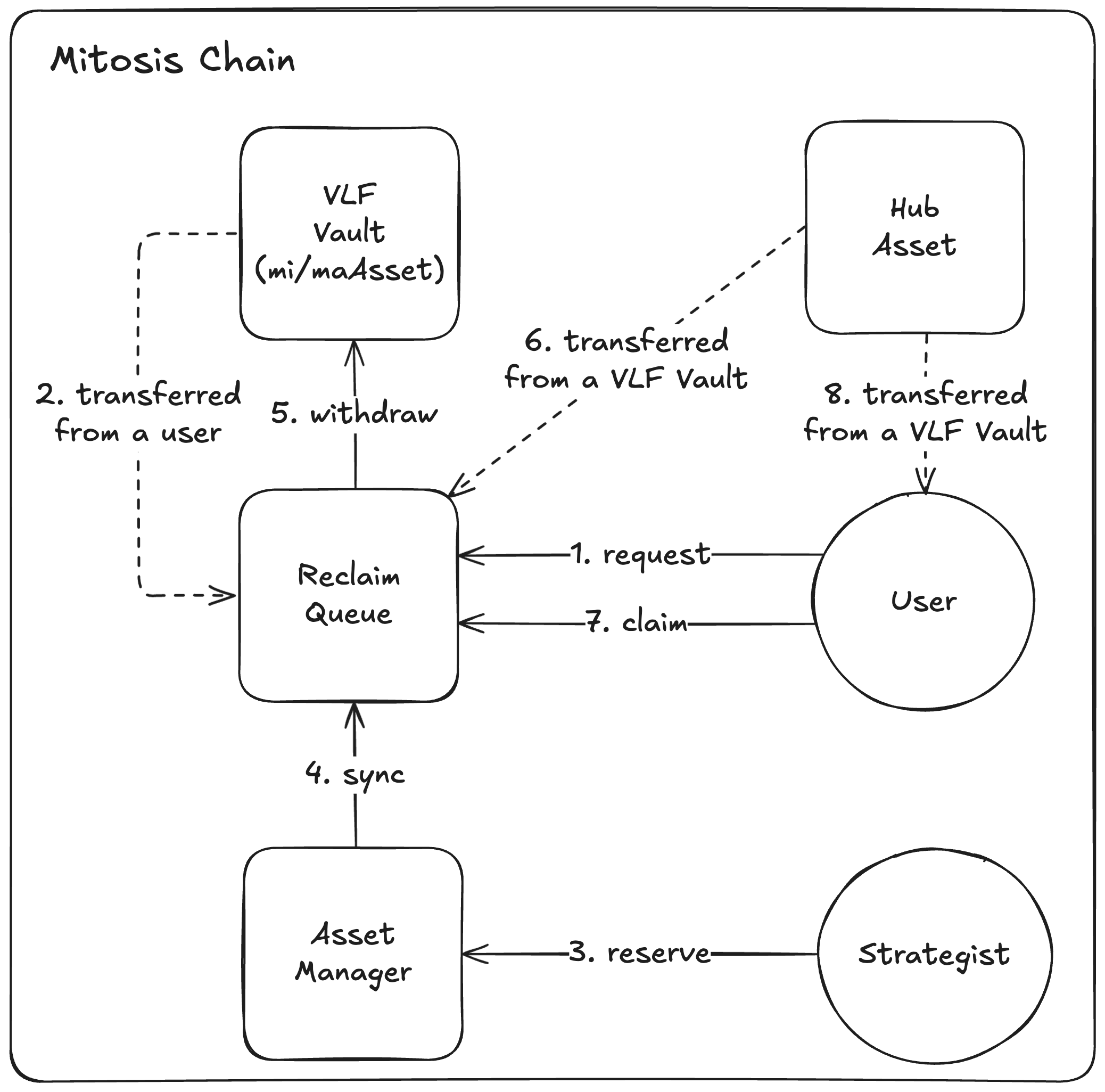

Reclaim Process

Unlike supply, the reclaim (redemption) process is not immediate and involves three main stages managed by the ReclaimQueue contract:

Unlike supply, the reclaim (redemption) process is not immediate and involves three main stages managed by the ReclaimQueue contract:

Stage 1: Reclaim Initiation

1

Reclaim Request

User initiates reclaim process with a specific VLF Vault

2

VLF Asset Transfer

User’s requested amount of VLF assets are transferred to Reclaim Queue

3

Queue Position

User’s request is placed in the reclaim queue for processing

Stage 2: Request Resolution

The reclaim request is resolved when both conditions are met:Liquidity Reservation

Sufficient underlying hub assets must be reserved for reclaim (not allocated to VLF strategies)

Waiting Period

Minimum waiting period (e.g., 7 days) must elapse for security

Liquidity Reservation Process

- Strategist Assessment: Strategist checks for idle hub assets not currently in use for VLF

- Reservation: If available, strategist reserves idle liquidity for reclaim

- Withdrawal from VLF: Reserved liquidity is withdrawn from VLF Vault and moved to Reclaim Queue, with corresponding VLF assets burned

- Allocation Lock: Reserved liquidity is no longer available for VLF strategies

Stage 3: Claim Execution

1

Resolution Check

Verify that request is resolved (liquidity reserved + waiting period complete)

2

Asset Claim

User claims against their resolved request to receive hub assets back

Why Delayed Reclaim?

The multi-stage reclaim process provides several benefits:Strategy Stability

Prevents sudden liquidity withdrawals that could disrupt active strategies

Yield Optimization

Allows strategies to plan for liquidity needs and optimize yield generation

Risk Management

Provides time for risk assessment and proper strategy unwinding

Abuse Prevention

Prevents yield cherry-picking by blocking immediate supply-and-reclaim behavior