Vault Liquidity Frameworks

Settlement

Understanding VLF settlement mechanisms for yield, losses, and extra rewards

The VLF Settlement system periodically calculates the performance of VLF strategies and reward entitlement details for users. It synchronizes the status of assets utilized for VLF across branch chains with the Mitosis Chain through three types of settlements.

The settlement system ensures transparent, accurate tracking of VLF performance while providing flexible distribution mechanisms for different types of rewards.

This settlement type handles performance changes in the underlying VLF strategies:

This settlement type handles performance changes in the underlying VLF strategies:

This settlement type handles rewards in different tokens than the underlying assets:

This settlement type handles rewards in different tokens than the underlying assets:

Settlement Types

Yield Settlement

When VLF generates rewards of the same type as underlying assets, mints equivalent hub assets to increase VLF asset value

Loss Settlement

Burns hub assets from VLF Vault to decrease VLF asset value when strategies experience losses

Extra Rewards Settlement

When VLF generates rewards of different type than underlying assets, mints hub assets for reward tokens and distributes them appropriately

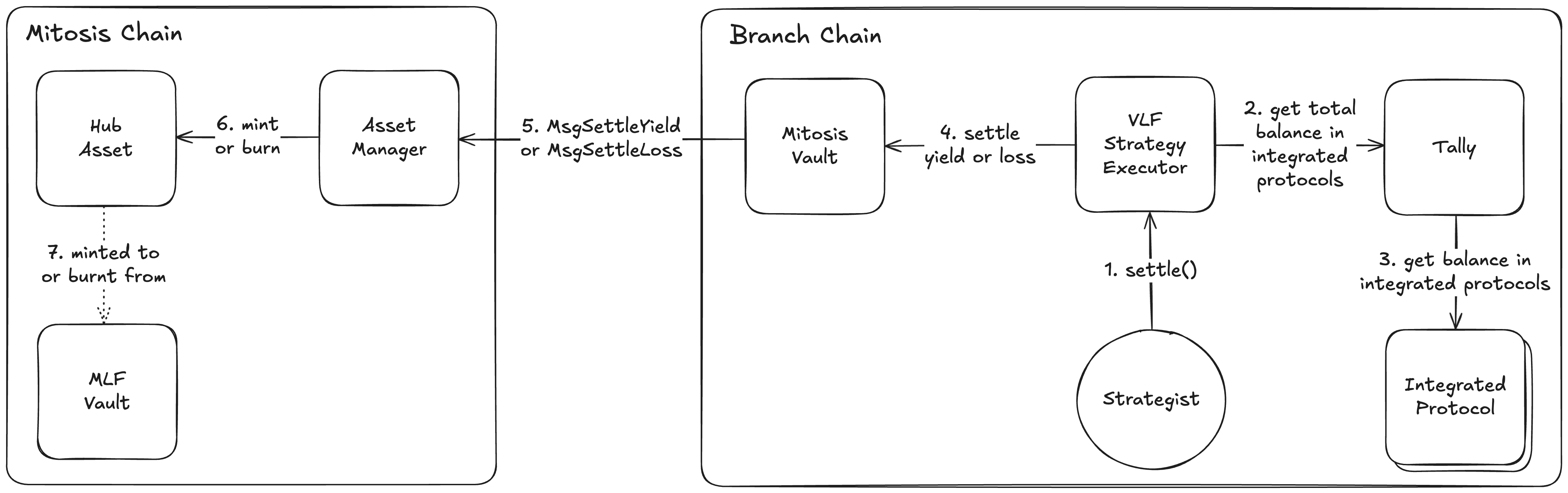

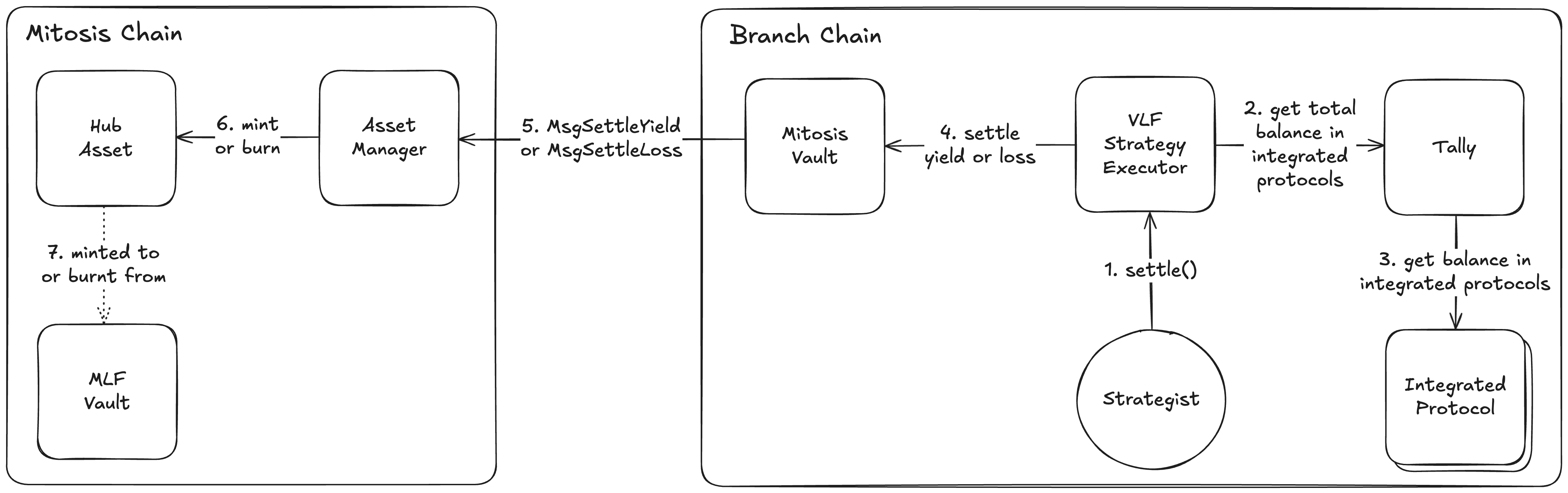

Yield/Loss Settlement

This settlement type handles performance changes in the underlying VLF strategies:

This settlement type handles performance changes in the underlying VLF strategies:

Settlement Process

1

Settlement Trigger

Strategist triggers Yield/Loss Settlement on the VLF Strategy Executor

2

Balance Calculation

System computes total balance of underlying assets managed by VLF Strategy Executor, including both direct holdings and assets deployed in integrated DeFi protocols

3

Performance Determination

Current total balance is compared to last settled total balance, with the difference indicating whether there was yield (positive) or loss (negative)

4

Cross-Chain Messaging

Settlement information is transmitted to Asset Manager via cross-chain messaging

5

Hub Asset Adjustment

Asset Manager triggers minting (yield) or burning (loss) of hub assets from VLF Vault

Examples

Yield Settlement Example

Scenario: Compound strategy earns 5% APY over settlement period- Previous Settlement: 100 ETH total balance

- Current Balance: 105 ETH (100 ETH principal + 5 ETH interest)

- Yield Detected: +5 ETH

- Action: Mint 5 ETH hub assets to VLF Vault

- Result: VLF asset holders benefit from increased share value

Loss Settlement Example

Scenario: Strategy experiences 2% loss due to market conditions- Previous Settlement: 100 ETH total balance

- Current Balance: 98 ETH (market downturn)

- Loss Detected: -2 ETH

- Action: Burn 2 ETH hub assets from VLF Vault

- Result: VLF asset value decreases proportionally

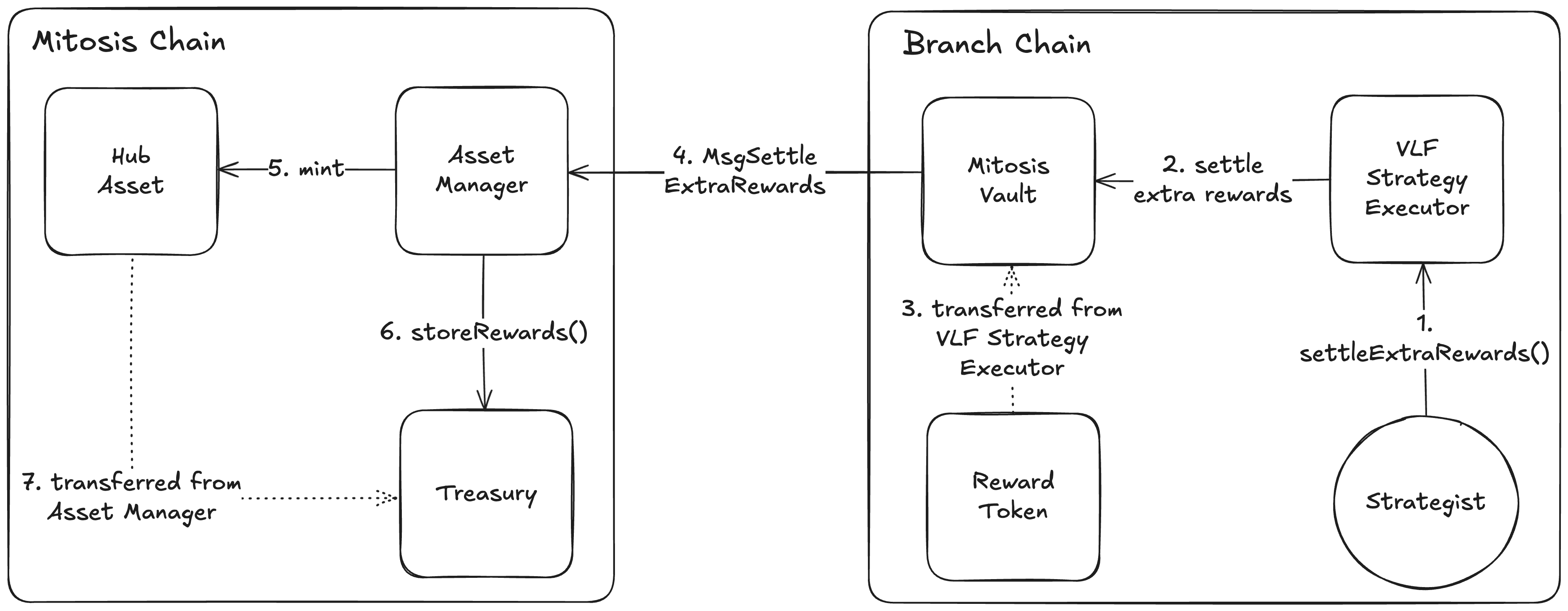

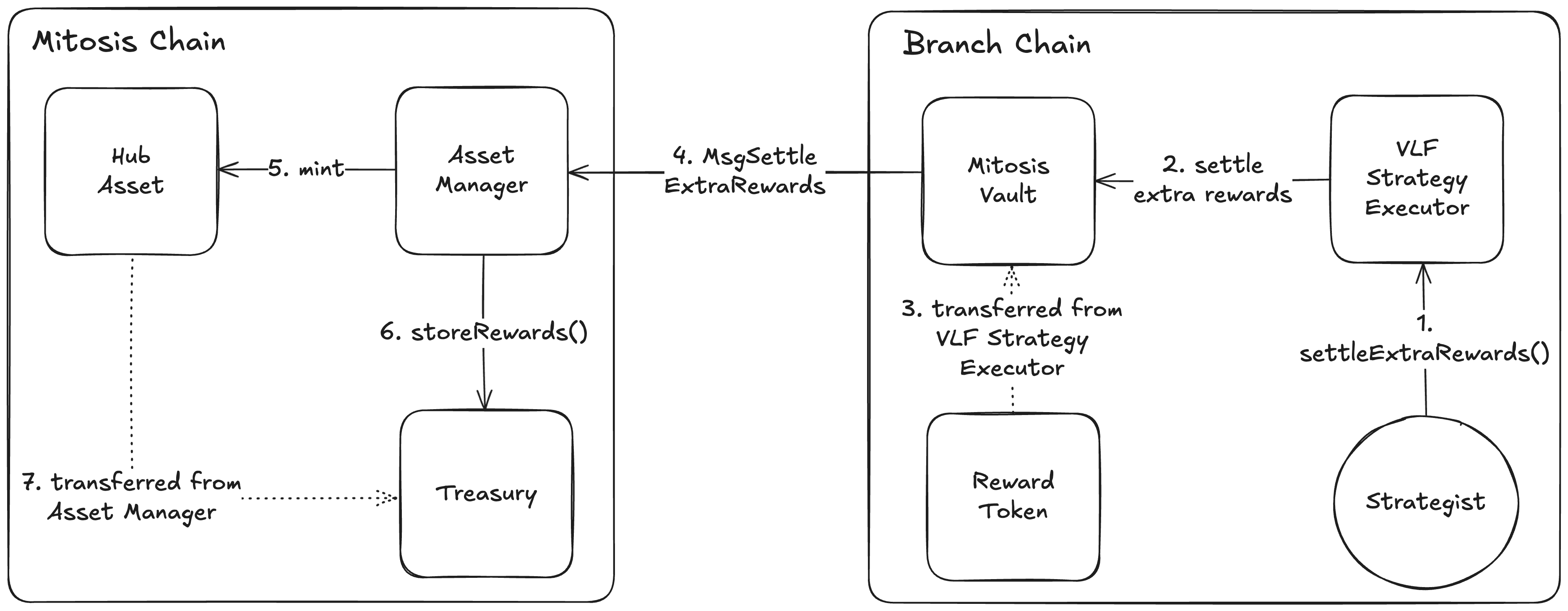

Extra Rewards Settlement

This settlement type handles rewards in different tokens than the underlying assets:

This settlement type handles rewards in different tokens than the underlying assets:

Settlement Process

1

Reward Token Detection

Strategist identifies reward tokens earned by VLF strategies

2

Settlement Trigger

Strategist triggers Extra Rewards Settlement on VLF Strategy Executor

3

Token Transfer

Reward tokens are transferred from VLF Strategy Executor to Mitosis Vault for safekeeping

4

Cross-Chain Messaging

Settlement information is transmitted to Asset Manager via cross-chain messaging

5

Hub Asset Minting

Asset Manager mints hub assets corresponding to reward tokens

6

Treasury Storage

Minted hub assets are stored in Treasury for distribution

7

User Distribution

Hub assets are distributed to users through appropriate methods

Example

Scenario: Morpho lending earns MORPHO tokens- Strategy: Supply ETH to Morpho lending protocol

- Reward Earned: 150 MORPHO tokens over settlement period

- Settlement Action:

- Transfer 150 MORPHO to Mitosis Vault

- Mint 150 MORPHO hub assets

- Store in Treasury

- Distribution: Merkle proof-based distribution to VLF participants