Vault Liquidity Frameworks

Liquidity Allocation

Understanding VLF liquidity allocation and management across branch chains

After users deposit hub assets into VLF Vaults, the underlying assets corresponding to these hub assets on the branch chain can be utilized for VLF liquidity opportunities. The Asset Manager maintains a comprehensive ledger for each VLF Vault tracking both allocated and idle liquidity.

The liquidity allocation system provides flexible, secure management of VLF liquidity across multiple chains while maintaining transparency and user control over their assets.

The strategist is the key role responsible for controlling liquidity allocation decisions across the system.

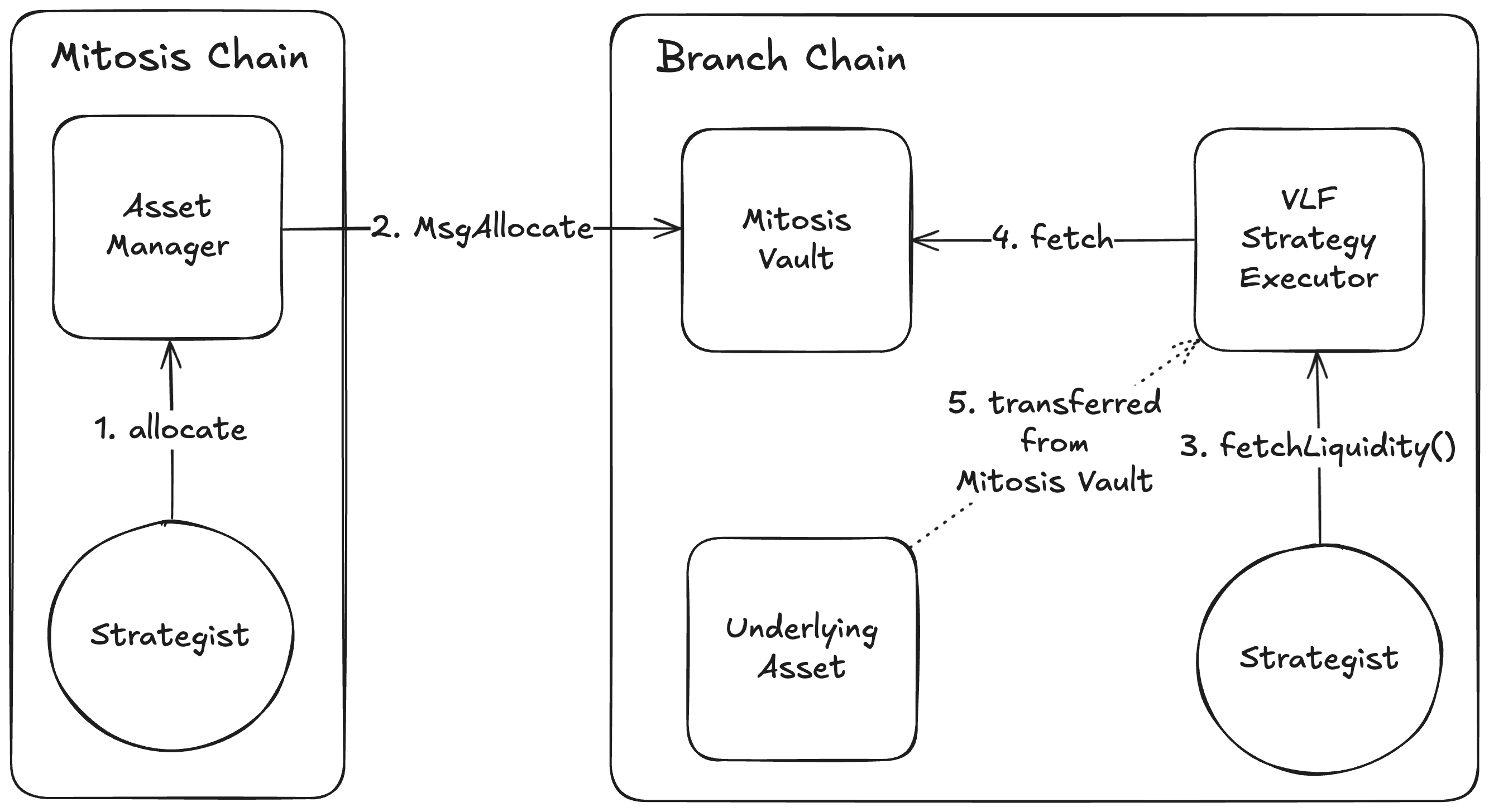

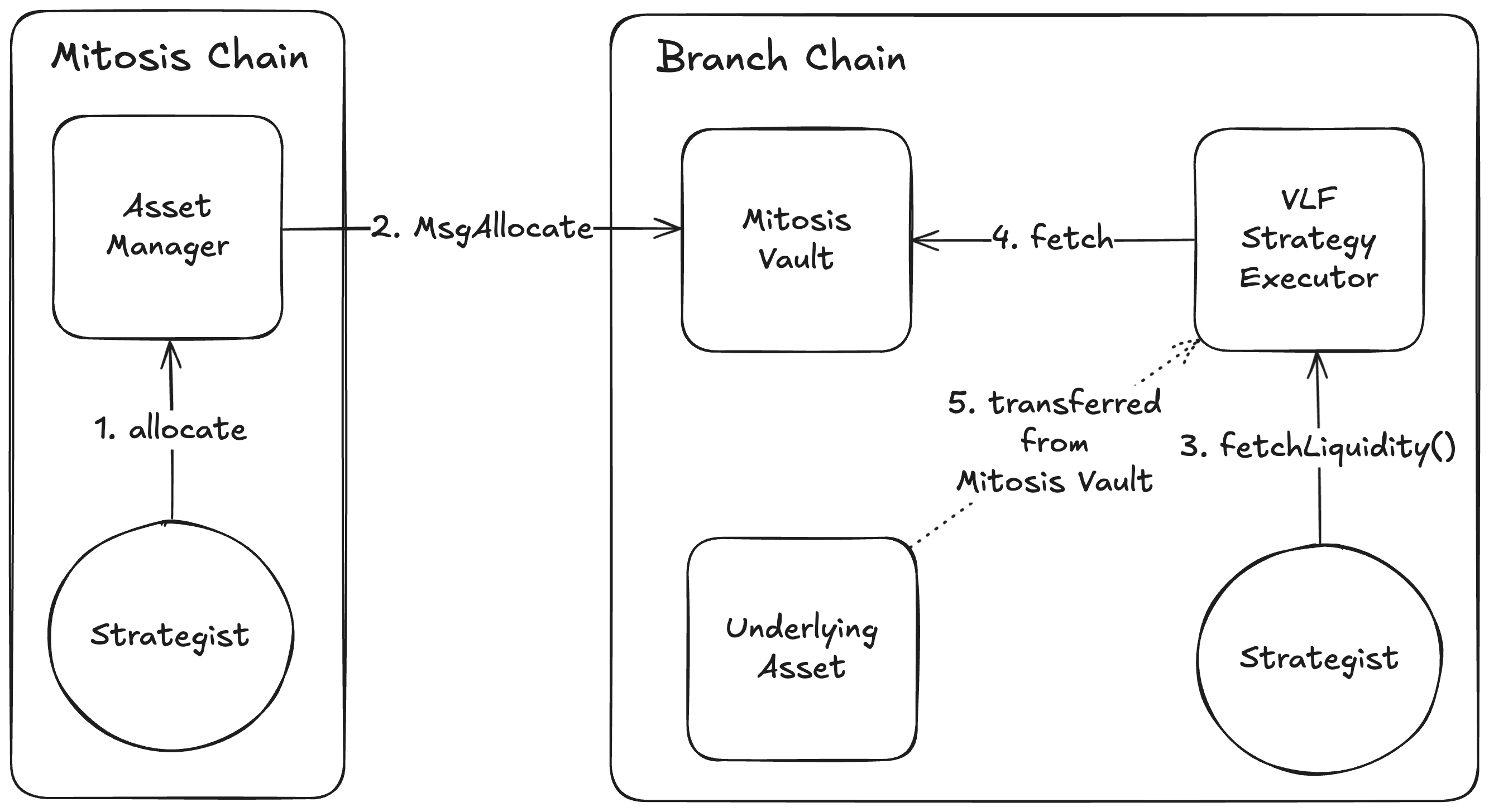

The process of utilizing idle liquidity from a VLF Vault for VLF strategies involves several coordinated steps:

Asset Manager Validation Checks:

The process of utilizing idle liquidity from a VLF Vault for VLF strategies involves several coordinated steps:

Asset Manager Validation Checks:

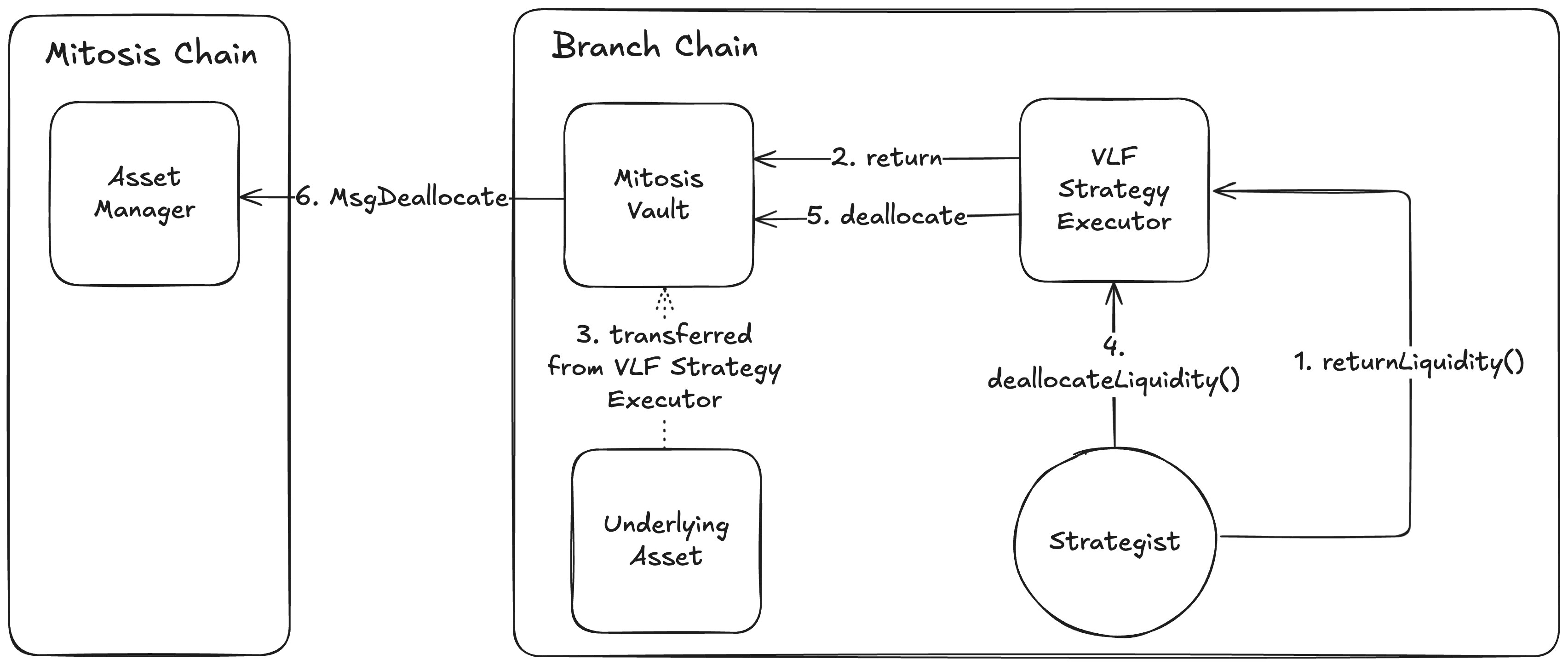

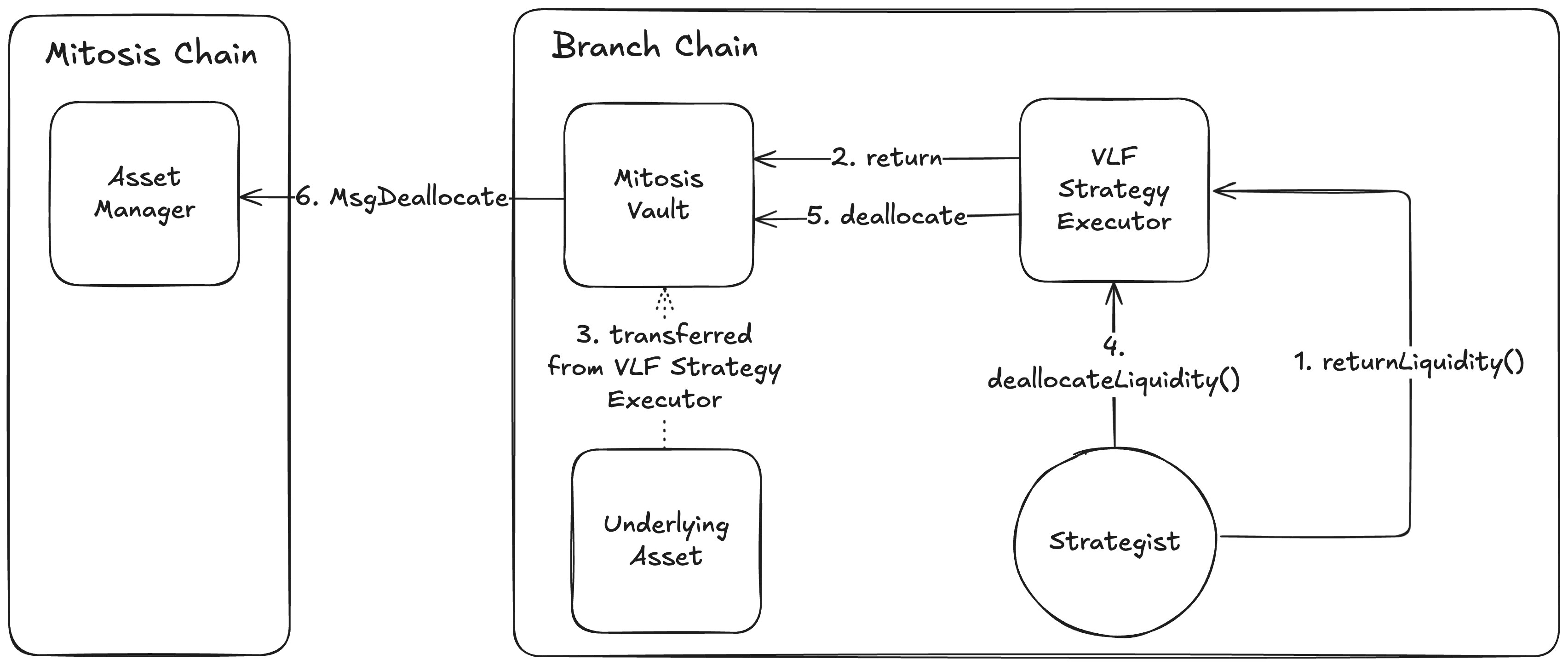

The reverse process converts allocated liquidity back to idle liquidity in the VLF Vault:

The reverse process converts allocated liquidity back to idle liquidity in the VLF Vault:

Liquidity States

Allocated Liquidity

Liquidity allocated for use in a VLF strategy on a specific branch chain

Idle Liquidity

Liquidity currently deposited in the VLF Vault but not yet allocated to any strategy

Liquidity Allocation Process

The process of utilizing idle liquidity from a VLF Vault for VLF strategies involves several coordinated steps:

The process of utilizing idle liquidity from a VLF Vault for VLF strategies involves several coordinated steps:

Step 1: Strategist Decision

1

Strategy Assessment

Strategist analyzes available opportunities and determines optimal allocation

2

Chain Selection

Strategist decides which branch chain to allocate idle liquidity from a specific VLF Vault

3

Allocation Execution

Strategist executes the allocation through the Asset Manager, which performs validation checks

Idle Liquidity Check

Confirms sufficient idle liquidity exists in the VLF Vault

Branch Chain Liquidity

Verifies adequate liquidity exists in the Mitosis Vault of the target branch chain

Step 2: Ledger Update

Once validation passes:- Asset Manager modifies its internal ledger data

- Idle liquidity is converted to allocated liquidity

- Allocation is recorded with specific branch chain

Step 3: Liquidity Utilization

1

Cross-chain Messaging

Allocation information is transmitted to the Mitosis Vault on the branch chain via cross-chain messaging

2

Liquidity Availability

The specified amount of liquidity becomes available for use by the VLF Strategy Executor

3

Fetch Liquidity

Strategist fetches the permitted amount of liquidity from Mitosis Vault to VLF Strategy Executor through

fetchLiquidity() function4

Strategy Deployment

Liquidity in the VLF Strategy Executor is utilized according to predefined VLF strategies to generate yield

Liquidity Deallocation Process

The reverse process converts allocated liquidity back to idle liquidity in the VLF Vault:

The reverse process converts allocated liquidity back to idle liquidity in the VLF Vault:

Step 1: Strategy Unwinding & Deallocation

1

Strategy Unwinding & Return

Strategist unwinds positions and calls

returnLiquidity() to move assets from VLF Strategy Executor back to Mitosis Vault2

Deallocation & Access Restriction

Strategist calls

deallocateLiquidity() function which restricts VLF Strategy Executor access to the specified liquidity amount3

Cross-Chain Messaging

Deallocation information is transmitted to Asset Manager via cross-chain messaging

Step 2: Ledger Update

Once deallocation information is received:- Asset Manager receives and processes the cross-chain message

- Allocated liquidity is converted back to idle liquidity for the VLF Vault

- Increased idle liquidity becomes available for new allocations or reclaim reservations